Use Case - Cubo Pago

Use Case - Cubo Pago

Use Case - Cubo Pago

Unlocking Financial Intelligence:

Transforming Raw Data into

Strategic Decision making

Unlocking Financial Intelligence:

Transforming Raw Data into

Strategic Decision making

Unlocking Financial Intelligence:

Transforming Raw Data into

Strategic Decision making

Industry

Industry

Fintech

Fintech

Product

Product

Finance

Finance

Problem

Problem

Shallow Analytics

Shallow Analytics

Data Product

Data Product

Data to Dashboard

Data to Dashboard

The Challenge

The Fintech Visibility Paradox

In the high-velocity world of Fintech, companies often process millions in volume yet suffer from surprisingly low visibility into their own performance. Cubo Pago was facing this exact paradox. Despite being a robust payment processor, their leadership team was effectively "flying blind." Critical growth metrics—such as Daily Transactions and Active Merchant Rates—were trapped inside operational silos. The CEO and key stakeholders needed to move beyond gut instinct and make decisions based on hard data, but they lacked a centralized warehouse capable of answering complex questions without disrupting the live transaction engines.

In the high-velocity world of Fintech, companies often process millions in volume yet suffer from surprisingly low visibility into their own performance. Cubo Pago was facing this exact paradox. Despite being a robust payment processor, their leadership team was effectively "flying blind." Critical growth metrics—such as Daily Transactions and Active Merchant Rates—were trapped inside operational silos. The CEO and key stakeholders needed to move beyond gut instinct and make decisions based on hard data, but they lacked a centralized warehouse capable of answering complex questions without disrupting the live transaction engines.

The Cause

The Operational Data Trap

The primary barrier to intelligence wasn't a lack of data, but the inability to access it at scale. Cubo Pago’s data was locked in a rigid AWS RDS Postgres environment designed for transaction processing, not analysis. Every attempt to extract historical insights resulted in system timeouts, malformed files, and significant manual overhead. This "data friction" meant that by the time a report was generated, the information was stale. The engineering team was spending hours fighting brittle, manual extraction processes instead of building value, leaving the C-suite with no clear data lineage to trust.

The primary barrier to intelligence wasn't a lack of data, but the inability to access it at scale. Cubo Pago’s data was locked in a rigid AWS RDS Postgres environment designed for transaction processing, not analysis. Every attempt to extract historical insights resulted in system timeouts, malformed files, and significant manual overhead. This "data friction" meant that by the time a report was generated, the information was stale. The engineering team was spending hours fighting brittle, manual extraction processes instead of building value, leaving the C-suite with no clear data lineage to trust.

The Solution

A Fault-Tolerant Modern Data Stack

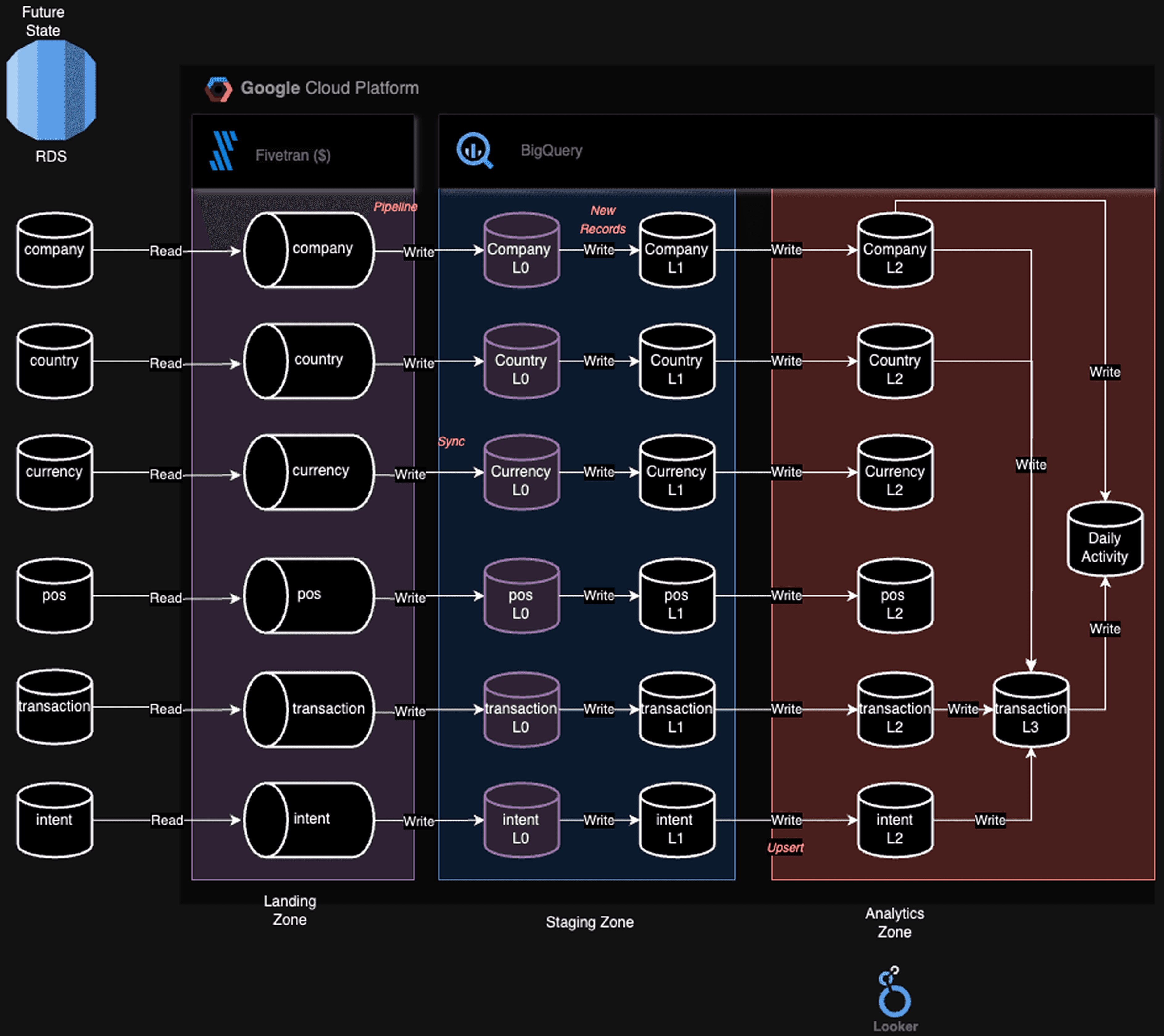

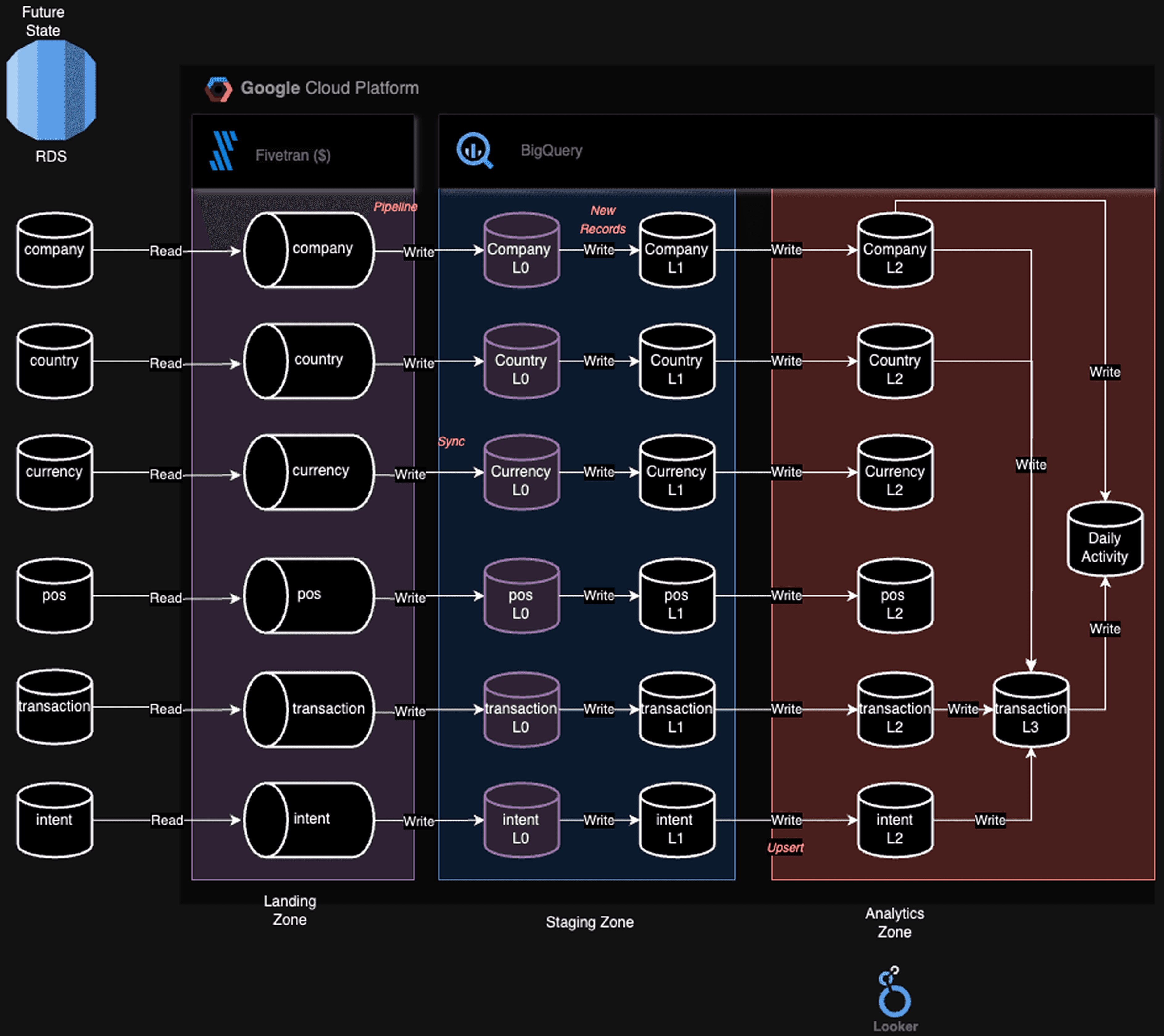

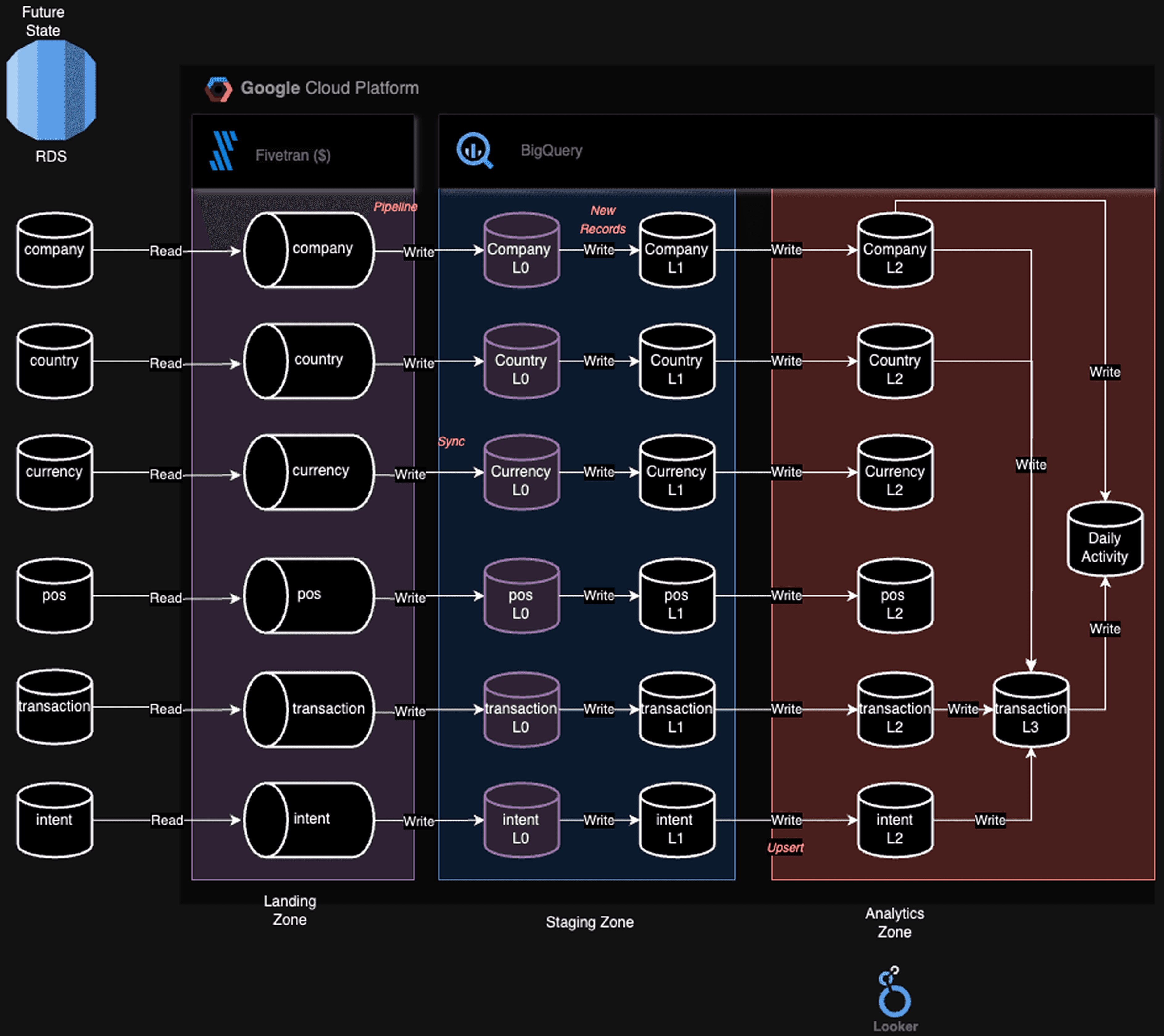

We didn't just patch the reporting; we engineered a completely new financial intelligence engine using Google Cloud Platform. We implemented a scalable ELT (Extract, Load, Transform) architecture that bypasses legacy constraints by moving raw data directly into BigQuery and Looker as the Business Intelligence Layer.

Table Leveling (L0–L3): We deployed a sophisticated layering system that automatically cleans, normalizes, and aggregates data, ensuring complete fault tolerance.

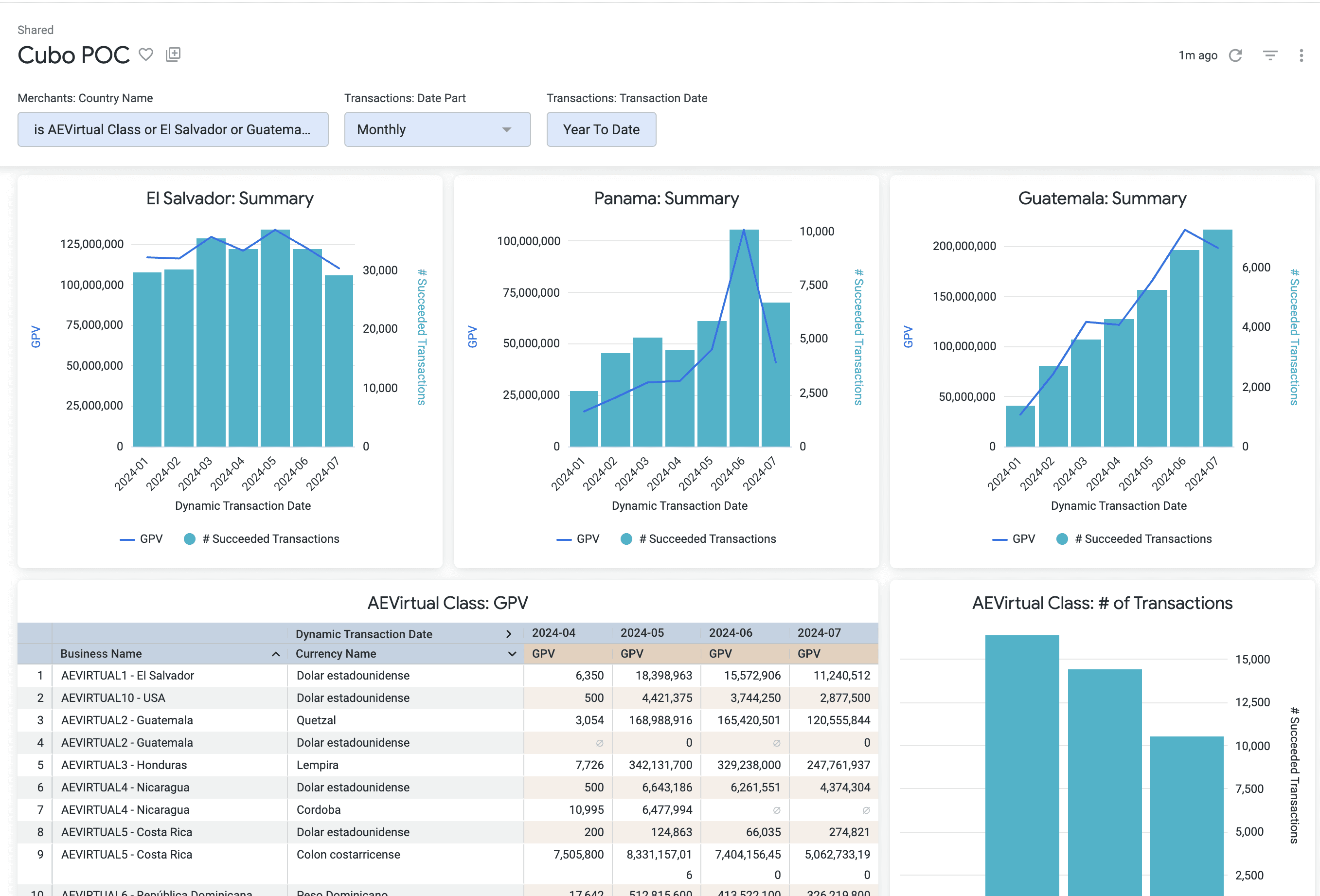

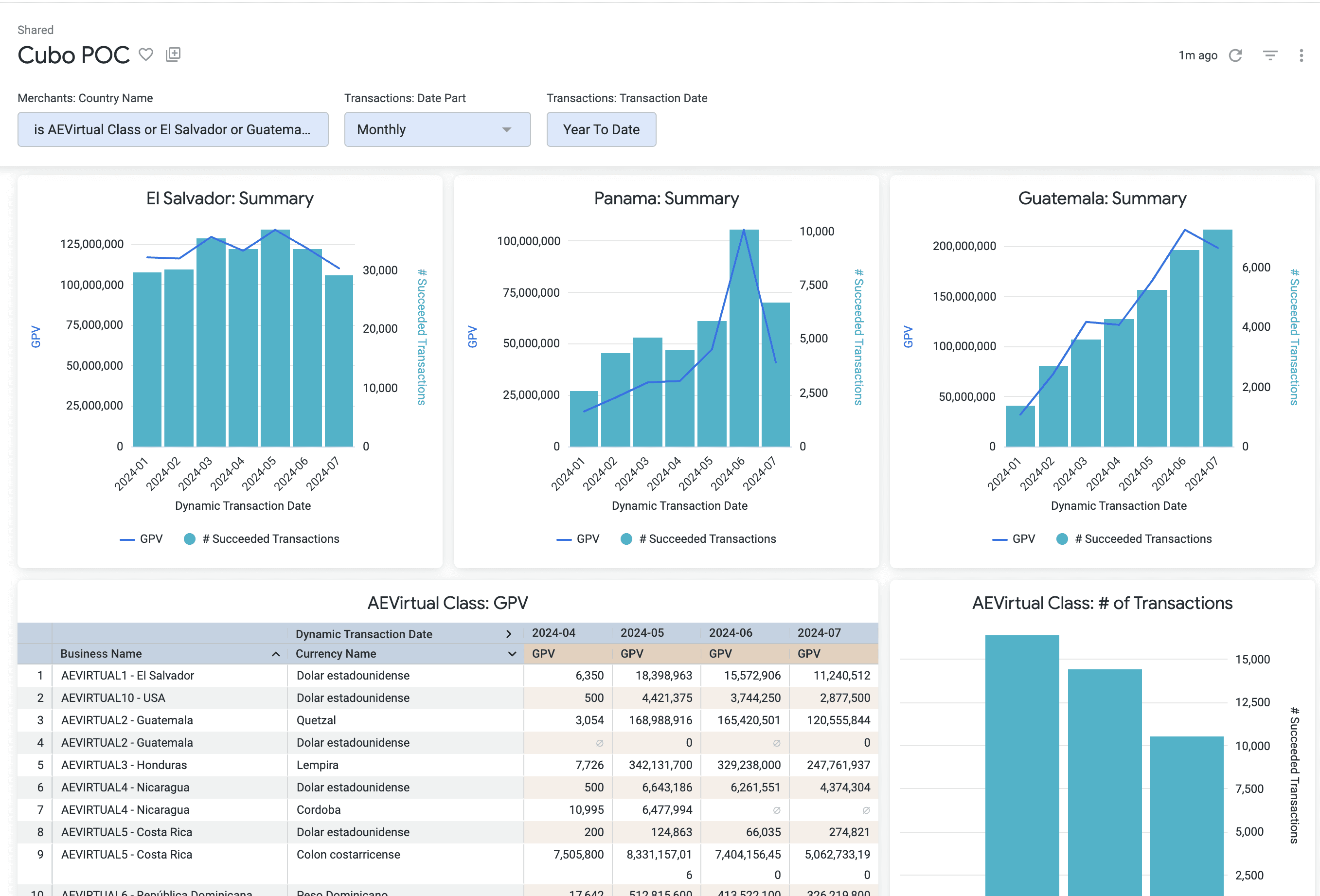

Looker Implementation: Recognizing that data is only as good as its presentation, we integrated Looker as the primary visualization layer. Looker serves as the "window" into the business, allowing non-technical executives to explore live dashboards and complex financial models intuitively.

We didn't just patch the reporting; we engineered a completely new financial intelligence engine using Google Cloud Platform. We implemented a scalable ELT (Extract, Load, Transform) architecture that bypasses legacy constraints by moving raw data directly into BigQuery and Looker as the Business Intelligence Layer.

Table Leveling (L0–L3): We deployed a sophisticated layering system that automatically cleans, normalizes, and aggregates data, ensuring complete fault tolerance.

Looker Implementation: Recognizing that data is only as good as its presentation, we integrated Looker as the primary visualization layer. Looker serves as the "window" into the business, allowing non-technical executives to explore live dashboards and complex financial models intuitively.

We didn't just patch the reporting; we engineered a completely new financial intelligence engine using Google Cloud Platform. We implemented a scalable ELT (Extract, Load, Transform) architecture that bypasses legacy constraints by moving raw data directly into BigQuery and Looker as the Business Intelligence Layer.

Table Leveling (L0–L3): We deployed a sophisticated layering system that automatically cleans, normalizes, and aggregates data, ensuring complete fault tolerance.

Looker Implementation: Recognizing that data is only as good as its presentation, we integrated Looker as the primary visualization layer. Looker serves as the "window" into the business, allowing non-technical executives to explore live dashboards and complex financial models intuitively.

Our Architecture

The Results

The Revenue Revelation

The impact of the new architecture was immediate and transformative. Once we established a pristine source of truth, we uncovered a massive strategic insight that had been hidden by the old manual reporting: while total transaction volume had slightly decreased, Cubo Pago was actually earning significantly more revenue. The data revealed that the average ticket size had increased dramatically—a trend completely invisible to the team before this project. Cubo Pago now operates with a fully automated, self-documenting pipeline that doesn't just report on the past, but actively illuminates the path to future profitability

The impact of the new architecture was immediate and transformative. Once we established a pristine source of truth, we uncovered a massive strategic insight that had been hidden by the old manual reporting: while total transaction volume had slightly decreased, Cubo Pago was actually earning significantly more revenue. The data revealed that the average ticket size had increased dramatically—a trend completely invisible to the team before this project. Cubo Pago now operates with a fully automated, self-documenting pipeline that doesn't just report on the past, but actively illuminates the path to future profitability

The impact of the new architecture was immediate and transformative. Once we established a pristine source of truth, we uncovered a massive strategic insight that had been hidden by the old manual reporting: while total transaction volume had slightly decreased, Cubo Pago was actually earning significantly more revenue. The data revealed that the average ticket size had increased dramatically—a trend completely invisible to the team before this project. Cubo Pago now operates with a fully automated, self-documenting pipeline that doesn't just report on the past, but actively illuminates the path to future profitability